All Categories

Featured

A financial investment car, such as a fund, would certainly need to identify that you certify as a certified financier - reg d offering accredited investor. To do this, they would certainly ask you to fill in a questionnaire and potentially supply specific documents, such as financial statements, credit scores records. number of accredited investors, or income tax return. The benefits of being an approved capitalist include access to special investment opportunities not available to non-accredited financiers, high returns, and raised diversity in your profile.

In certain regions, non-accredited financiers additionally can rescission (accredited investor in us). What this suggests is that if a financier decides they wish to draw out their money early, they can assert they were a non-accredited financier during and obtain their refund. It's never a great concept to supply falsified records, such as phony tax obligation returns or financial declarations to an investment lorry simply to spend, and this could bring legal difficulty for you down the line (accredited investor series 7).

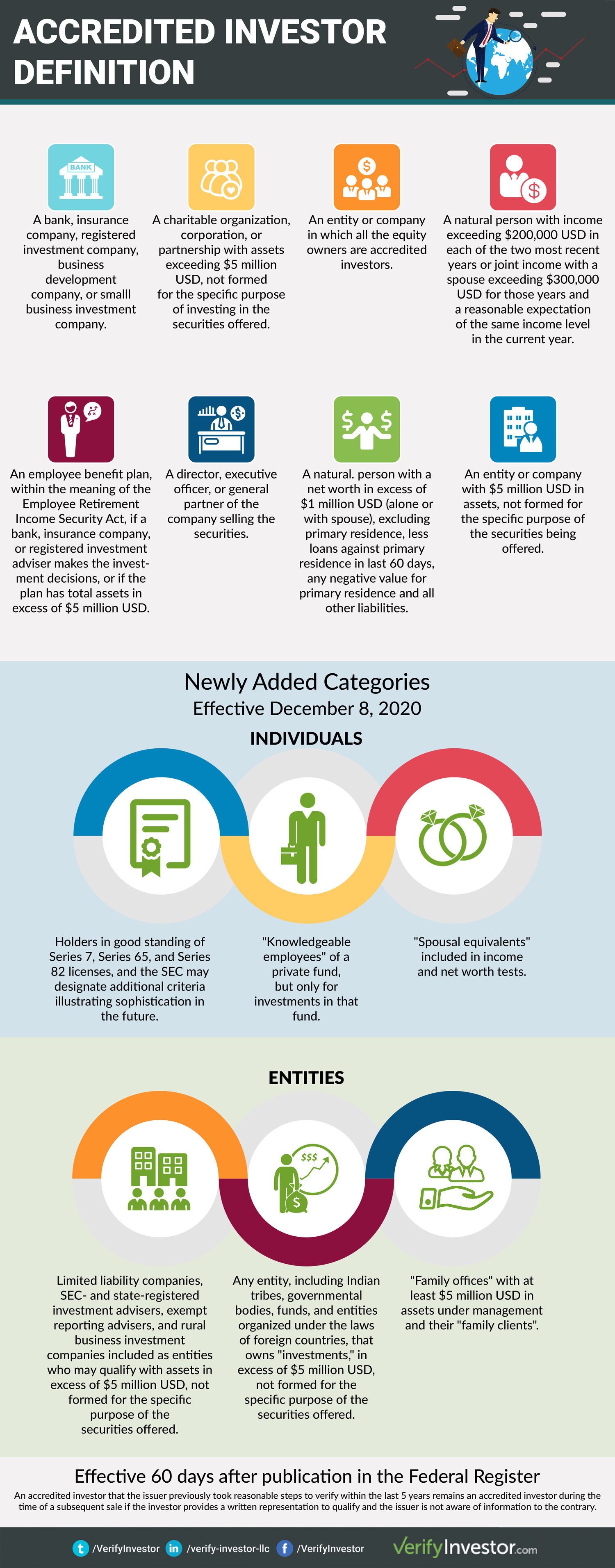

That being said, each deal or each fund might have its own restrictions and caps on investment quantities that they will approve from a financier (accredited investor securities act). Certified investors are those that meet particular needs relating to earnings, qualifications, or net well worth. They are normally affluent individuals (investor eligibility). Accredited investors have the possibility to spend in non-registered investments offered by firms like personal equity funds, hedge funds, angel investments (opportunities for accredited investors), financial backing companies, and others.

Latest Posts

Surplus Funds Forms

List Of Tax Foreclosures

Investing In Tax Liens Certificates