All Categories

Featured

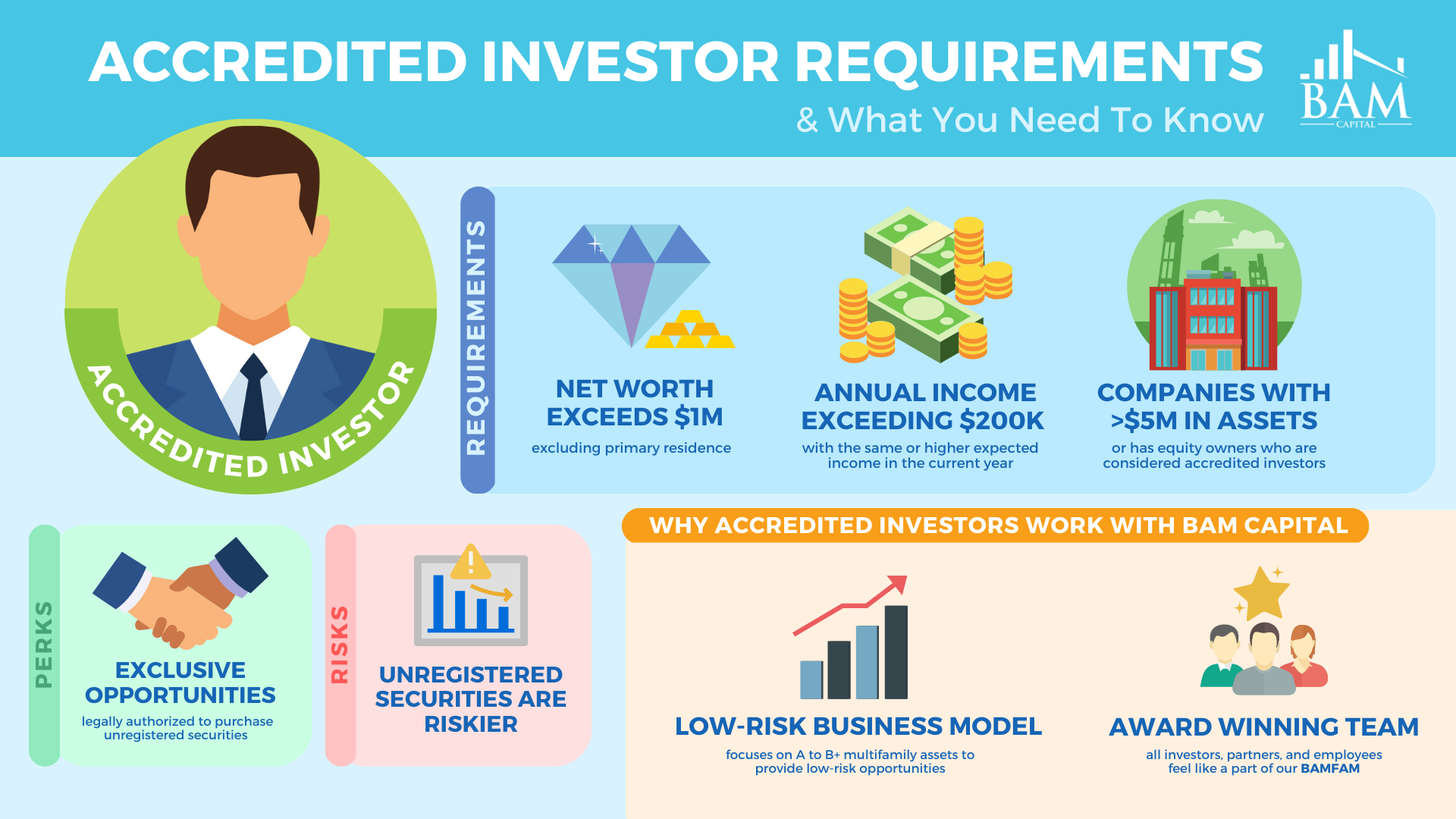

In 2020, an approximated 13.6 million united state families are certified investors. These houses regulate massive wide range, estimated at over $73 trillion, which represents over 76% of all exclusive riches in the U.S. These capitalists take part in investment chances generally unavailable to non-accredited capitalists, such as financial investments in private business and offerings by specific hedge funds, private equity funds, and equity capital funds, which allow them to expand their wide range.

Read on for details concerning the newest certified capitalist revisions. Financial institutions usually money the bulk, but rarely all, of the resources required of any kind of purchase.

There are primarily two rules that permit issuers of safeties to use unlimited quantities of safety and securities to capitalists. real estate investor qualifications. One of them is Policy 506(b) of Law D, which permits a company to offer safeties to limitless accredited capitalists and as much as 35 Advanced Financiers just if the offering is NOT made with general solicitation and basic advertising and marketing

The freshly embraced modifications for the very first time accredit specific financiers based upon monetary class demands. Numerous various other modifications made to Regulation 215 and Rule 114 A clarify and expand the checklist of entity kinds that can certify as a recognized financier. Right here are a few highlights. The changes to the accredited capitalist definition in Policy 501(a): include as certified financiers any trust, with complete properties a lot more than $5 million, not developed specifically to purchase the subject safety and securities, whose acquisition is routed by a sophisticated person, or consist of as recognized investors any type of entity in which all the equity proprietors are recognized capitalists.

Under the federal safety and securities laws, a company might not provide or offer securities to capitalists without registration with the SEC. However, there are a variety of registration exemptions that inevitably increase deep space of possible capitalists. Many exemptions call for that the financial investment offering be made only to individuals that are certified financiers.

Furthermore, accredited financiers commonly get extra beneficial terms and higher potential returns than what is offered to the public. This is because private placements and hedge funds are not required to abide with the same regulative demands as public offerings, permitting even more adaptability in regards to investment strategies and potential returns.

Earn Your Accredited

One factor these security offerings are restricted to accredited financiers is to make sure that all taking part investors are economically innovative and able to take care of themselves or sustain the threat of loss, therefore making unnecessary the protections that come from an authorized offering. Unlike security offerings registered with the SEC in which particular information is called for to be disclosed, business and exclusive funds, such as a hedge fund - how to become an accredited investor canada or equity capital fund, taking part in these exempt offerings do not have to make prescribed disclosures to recognized financiers.

The internet worth test is relatively easy. Either you have a million dollars, or you do not. However, on the earnings test, the individual needs to please the limits for the 3 years consistently either alone or with a spouse, and can not, for example, please one year based upon private earnings and the following two years based upon joint income with a partner.

Latest Posts

Surplus Funds Forms

List Of Tax Foreclosures

Investing In Tax Liens Certificates