All Categories

Featured

Table of Contents

- – How do I choose the right Private Real Estate ...

- – What is included in Real Estate Investment Par...

- – How does Real Estate Investing For Accredited...

- – Who has the best support for Commercial Real ...

- – What does Accredited Investor Real Estate Pl...

- – How do I exit my Accredited Investor Propert...

Rehabbing a house is thought about an energetic investment strategy. On the other hand, easy actual estate investing is great for financiers that want to take a less involved approach.

With these techniques, you can delight in easy earnings in time while enabling your investments to be managed by somebody else (such as a property administration firm). The only point to maintain in mind is that you can lose out on some of your returns by working with another person to manage the investment.

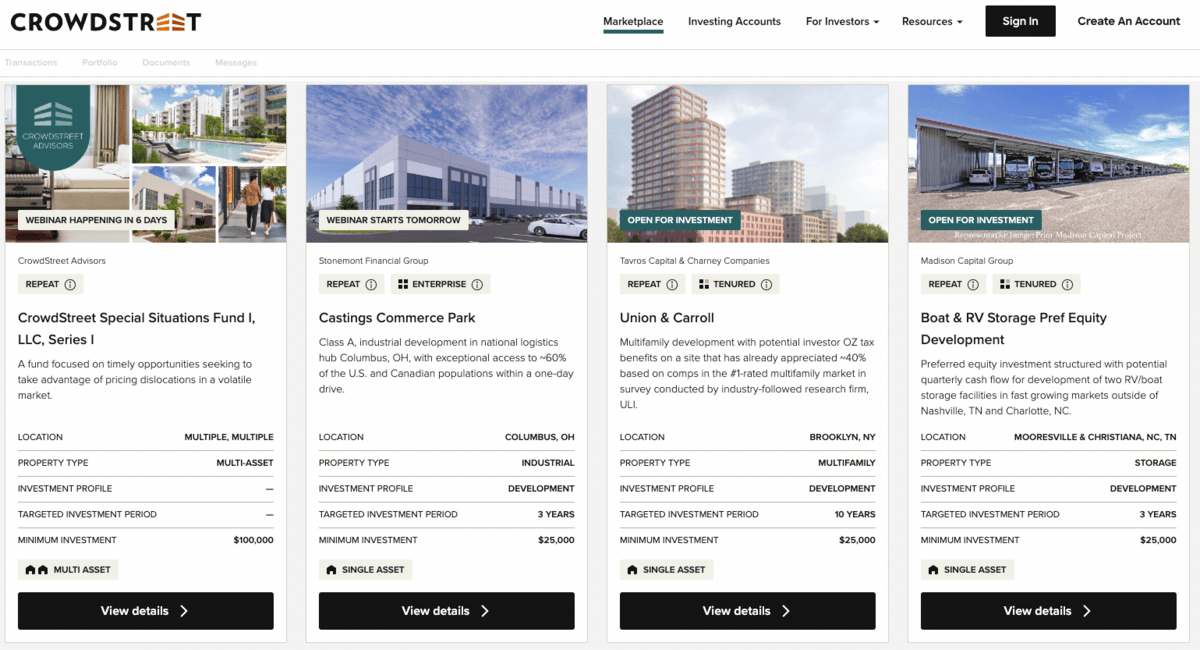

An additional consideration to make when selecting a real estate investing technique is straight vs. indirect. Similar to active vs. passive investing, direct vs. indirect refers to the level of involvement required. Direct financial investments involve in fact buying or managing properties, while indirect methods are much less hands on. As an example, REIT spending or crowdfunded buildings are indirect realty investments.

Register to attend a FREE on-line property course and find out just how to start investing in property.] Several capitalists can obtain so captured up in identifying a property type that they don't understand where to start when it pertains to locating an actual residential or commercial property. So as you familiarize yourself with different building kinds, likewise be sure to learn where and how to discover each one.

How do I choose the right Private Real Estate Investments For Accredited Investors for me?

There are lots of buildings on the marketplace that fly under the radar since investors and buyers do not know where to look. A few of these residential properties suffer from poor or non-existent marketing, while others are overpriced when provided and therefore fell short to obtain any type of interest. This indicates that those investors going to arrange via the MLS can find a selection of financial investment chances.

This way, capitalists can regularly track or look out to brand-new listings in their target location. For those wondering just how to make connections with realty representatives in their particular areas, it is a good idea to go to local networking or realty event. Financiers searching for FSBOs will certainly also find it helpful to collaborate with a realty agent.

What is included in Real Estate Investment Partnerships For Accredited Investors coverage?

Financiers can likewise drive via their target areas, trying to find indicators to discover these properties. Keep in mind, recognizing residential properties can require time, and capitalists must be all set to utilize numerous angles to secure their following offer. For investors residing in oversaturated markets, off-market properties can represent a possibility to be successful of the competition.

When it comes to looking for off-market homes, there are a couple of resources capitalists must check. These include public records, real estate public auctions, dealers, networking events, and professionals.

How does Real Estate Investing For Accredited Investors work for high-net-worth individuals?

Years of backlogged repossessions and raised motivation for banks to repossess might leave even much more repossessions up for grabs in the coming months. Investors browsing for repossessions must pay cautious focus to newspaper listings and public records to locate possible homes.

You need to take into consideration investing in genuine estate after finding out the different benefits this asset has to provide. Usually, the consistent need provides real estate lower volatility when contrasted to various other investment types.

Who has the best support for Commercial Real Estate For Accredited Investors investors?

The factor for this is due to the fact that realty has low connection to various other financial investment kinds therefore supplying some protections to investors with other asset types. Various kinds of realty investing are associated with different levels of danger, so make sure to locate the right financial investment strategy for your objectives.

The process of buying residential property entails making a down settlement and funding the remainder of the price. Because of this, you just pay for a tiny percent of the building in advance however you control the whole financial investment. This kind of leverage is not available with various other financial investment kinds, and can be made use of to more expand your investment profile.

Nevertheless, due to the wide range of alternatives available, lots of capitalists likely find themselves wondering what actually is the best realty investment. While this is an easy question, it does not have a straightforward solution. The finest sort of investment residential property will certainly depend on numerous elements, and financiers ought to be cautious not to rule out any kind of choices when looking for potential offers.

This short article discovers the possibilities for non-accredited capitalists wanting to venture right into the lucrative realm of genuine estate (Real Estate for Accredited Investors). We will dive right into various financial investment opportunities, governing factors to consider, and techniques that equip non-accredited individuals to harness the capacity of actual estate in their investment portfolios. We will additionally highlight just how non-accredited investors can work to come to be recognized investors

What does Accredited Investor Real Estate Platforms entail?

These are normally high-net-worth individuals or business that satisfy certification demands to trade personal, riskier investments. Income Standards: Individuals ought to have a yearly earnings going beyond $200,000 for 2 successive years, or $300,000 when integrated with a spouse. Web Worth Requirement: A net well worth exceeding $1 million, excluding the main residence's value.

Investment Expertise: A clear understanding and awareness of the risks related to the investments they are accessing. Paperwork: Ability to supply monetary declarations or various other paperwork to verify revenue and total assets when asked for. Realty Syndications require accredited investors due to the fact that enrollers can only permit recognized financiers to sign up for their investment chances.

How do I exit my Accredited Investor Property Investment Opportunities investment?

The very first usual misunderstanding is when you're a recognized investor, you can maintain that condition forever. To come to be a recognized investor, one need to either strike the revenue criteria or have the web well worth requirement.

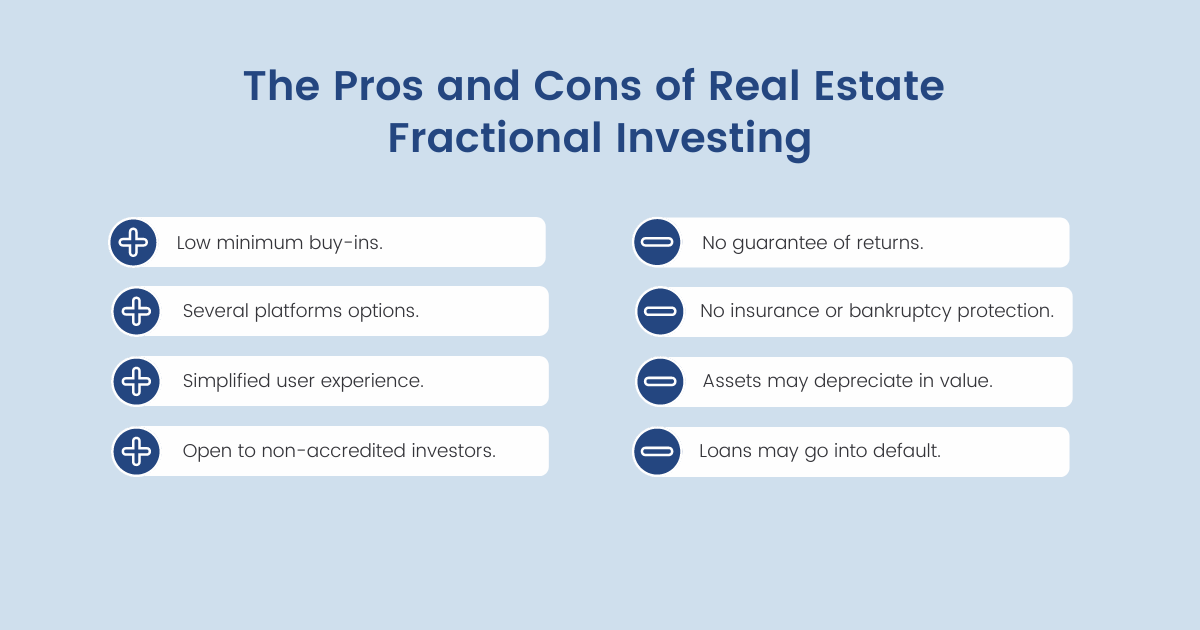

REITs are eye-catching because they generate stronger payouts than typical stocks on the S&P 500. High yield rewards Profile diversification High liquidity Rewards are taxed as common income Level of sensitivity to rate of interest rates Risks related to details homes Crowdfunding is a technique of on-line fundraising that includes asking for the public to add money or start-up capital for new projects.

This permits entrepreneurs to pitch their concepts directly to everyday web individuals. Crowdfunding offers the capability for non-accredited financiers to come to be investors in a company or in a realty residential property they would not have actually been able to have access to without certification. Another benefit of crowdfunding is profile diversification.

In lots of instances, the financial investment hunter needs to have a track record and is in the infancy stage of their job. This might suggest a higher danger of shedding a financial investment.

Table of Contents

- – How do I choose the right Private Real Estate ...

- – What is included in Real Estate Investment Par...

- – How does Real Estate Investing For Accredited...

- – Who has the best support for Commercial Real ...

- – What does Accredited Investor Real Estate Pl...

- – How do I exit my Accredited Investor Propert...

Latest Posts

Surplus Funds Forms

List Of Tax Foreclosures

Investing In Tax Liens Certificates

More

Latest Posts

Surplus Funds Forms

List Of Tax Foreclosures

Investing In Tax Liens Certificates